💼 Triple Net Lease Explained: What Every CRE Investor Should Include 🏢

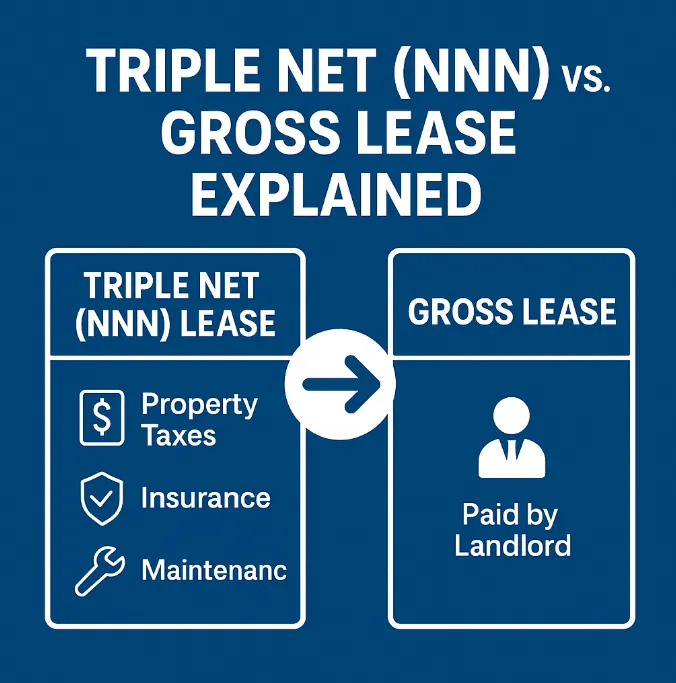

💼 What to Include in a Triple Net Lease: A Guide for Smart CRE Investors In commercial real estate, Triple Net Leases (NNN) are a favorite among investors because they create predictable income and reduce landlord headaches. But not every NNN lease is created equal — the details make all the difference in protecting your cash flow and long-term returns.